2 Beaten up resource stocks that present potential upside here.

The resource sector has been on sale the last couple years as capital has fled the Canadian markets it has presented some very interesting opportunities.

Kodiak Copper - $39 Million Market Cap

It’s been a long painful ride for shareholders who bought in late 2020, the stock has gone from nearly $3.50 all the way down to .40 cents, we have seen some recent strength in the name and it is currently trading at .60 cents and is on watch for a breakout.

The company made its initial discovery at the MPD project in British Columbia in 2020 when they hit over 500 metres of .5% Cu, Teck took a 10% stake after the hole and have continued to further investments the last couple of years.

Since the initial discovery the company has been able to make multiple discoveries on the property, the company has a really nice share structure currently and has $3 million in the bank. There is still some drill results pending from the previous season which could provide some upside here and the company has new targets to test in 2024.

This stock is worth a deep dive at the current share price and I believe presents potential upside with some of the new targets.

Century Lithium - $115 Million Market Cap

Lithium had become one of the most beaten up sectors in the market, all the stocks had a sharp dramatic downturn, I highlighted the sector in previous reports as being worth a look as a cyclical bottom was near.

I don’t see many talking about the sector yet, but the stocks have bounced extremely hard in the last month. One I had on my watchlist was Century Lithium which is already up over 100% in a month, and on watch for a more significant breakout now.

The stock was around $2.60 at it’s peak and currently trades at .78 cents. The company owns the Clayton Valley Lithium Project in Nevada which has already had a PFS completed and expects the Feasibility study to be complete any week now. The company aims to have a construction decision made in 2026.

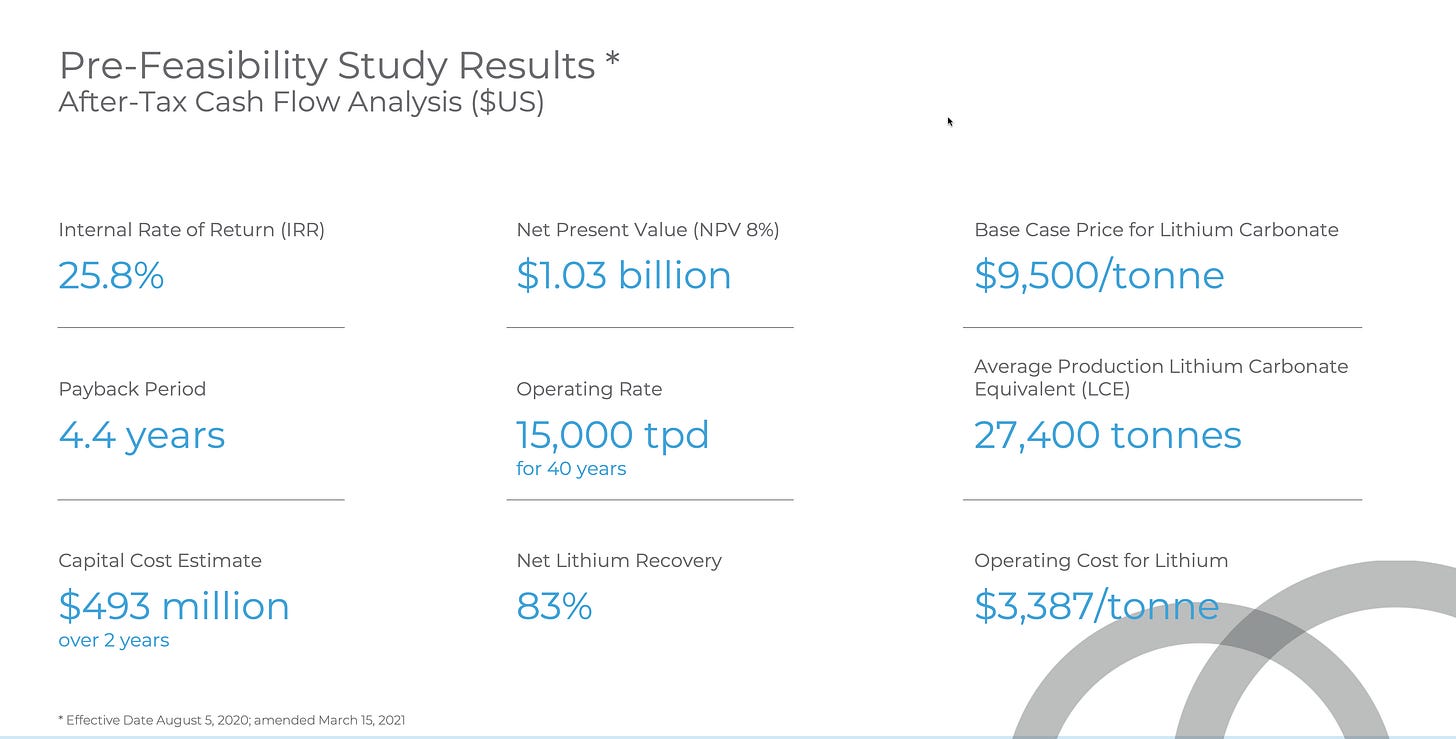

I like these developmental type stories during cycle bottoms as it’s easy to gauge the potential upside and value of the stock. Here is the economic results from the PFS in 2021.

The lithium priced used in the PFS was very low and happened before the big run up in Lithium, the current lithium price is still above the 9,500/tonne used here. The stock is trading at a massive discount to NPV8% of 1.03 billion $US used in the study.

The company has had a pilot plant running for 2 years and has had great success with Direct lithium extraction methods with very good results.

I believe this stock presents really good value at the current share price, and would be a great way to play the lithium cycle, the sector has bounced recently but its yet to be seen if this is the start of something bigger. Either way this is a story worth watching.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.