Amerigo Resources - A copper investment for the long term.

I recently took a position in the stock, which is currently yielding a 10% annual dividend yield with an interesting business model.

Amerigo Resources has been on my radar for several months now and I finally decided to take my initial position in the stock. Amerigo is a basically a bet on Copper prices staying elevated over the coming years due to coming supply constraints. The stock has an extremely attractive business model.

The company has an agreement in place with Codelco, Amerigo takes the tailings material from the world’s largest underground copper mine - El Teniente and recovers Copper and Molybdenum. This contract is in place until 2037 currently.

The company has great leverage to rising copper prices, and the companies main priority is returning capital to shareholders through dividends and share buybacks. Since late 2021 the company has returned over $50 million to shareholders through both of these avenues. They reduced share count from 180 million down to 160 million shares currently.

The company struggled a little bit in the third quarter due to reduced production, this was caused by historic rainfall in Chile after 10 years of drought conditions. The company has spent money on additional pumps and infastructure and if this occurs again it will not have the same effect. The company is on track to beat the Q4 2022 production numbers and believe they will exceed over 16 million lbs of production in the quarter. Cash costs in Q3 were just under 2.50 per lb.

Copper prices have been very stable around 3.50 per lb for over a year now and at that kind of level Amerigo will continue to make a nice profit. Even if we head closer to $3 or a little bit below that, Amerigo should still be able to make positive cashflow, although at those levels the dividend will may be cut or paused to sustain the company through that kind of pricing period.

We have all heard about the possibility of a large recession/debt crisis that potentially could be looming, in the event that were to occur, I would expect copper prices to get hit but how much of this is priced in already? Amerigo is a long term investment for me and in the event of a firesale happening I would add significantly to my position.

The copper supply situation is eventually going to come to a head and prices are going to have to rise significantly. There is no real big mines coming online in the coming years and alot of the large producing mines are aging and grades are decreasing. Copper mines are very expensive and take many years to develop and that’s if you can even get it permitted. Look at the current situation in Panama at the Cobre Mine to the risks involved with mining nowadays. That could be 1-2% of global copper production wiped out pretty fast. Which is more significant than it may sound.

Even with recession fears in 2023, Chinese copper refined demand has grown 8% year over year, what is even more bullish is that Indian copper demand was up over 30% from last year. As population’s grow in these countries and the standard of living increases the demand side is going to continue to look extremely bullish with a supply that just isn’t there right now.

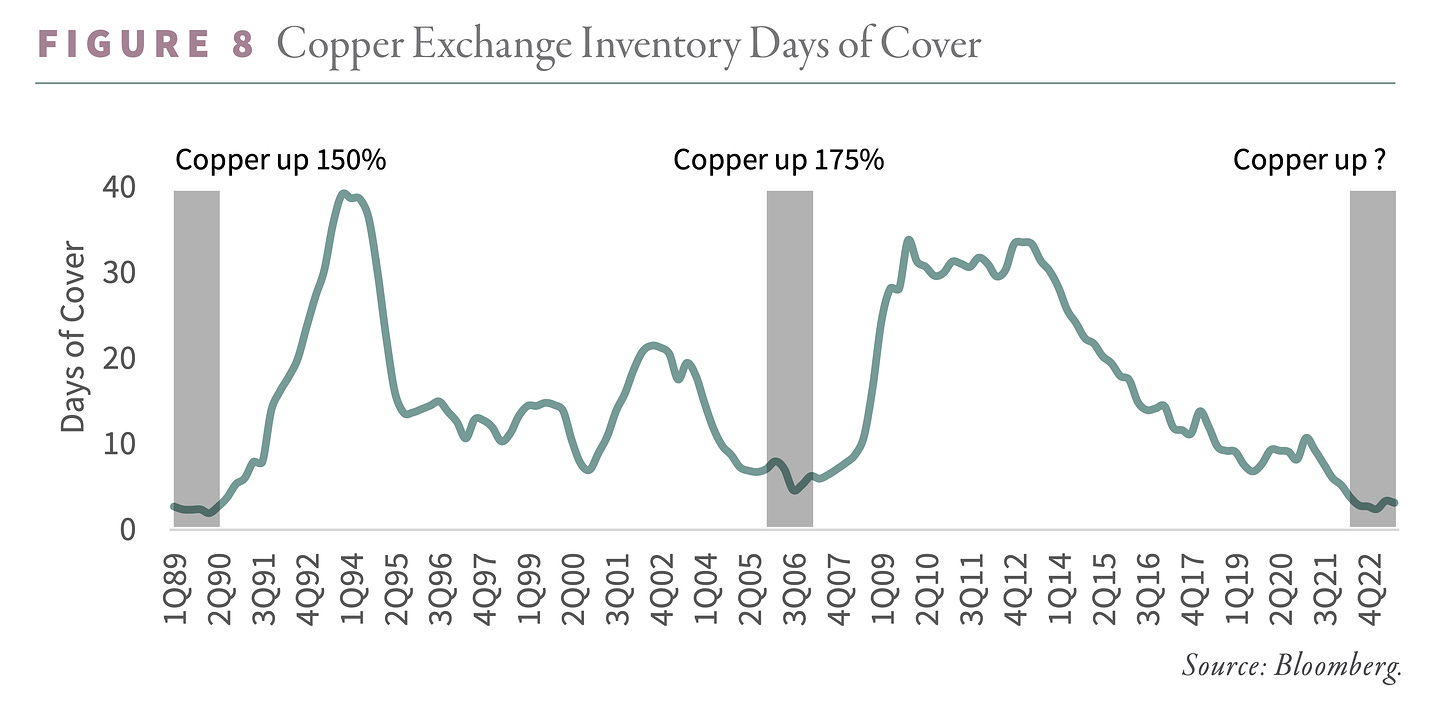

Copper inventories have plummeted and we are at levels comparable to 2005, which caused a massive price increase. I believe this is why copper prices have been so steady even with recession fears looming.

With Amerigo it’s a very simple business model with much less risk than a conventional producer, they have minimal Capex expenditures, no environmental liabilities, no exploration costs, minimal staff and costs. If copper does well so will Amerigo.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.