Arizona Silver on the path to a multi million ounce deposit.

I hadn't heard of the company until a few weeks ago, when the chart caught my attention, once I looked into the company I got extremely bullish.

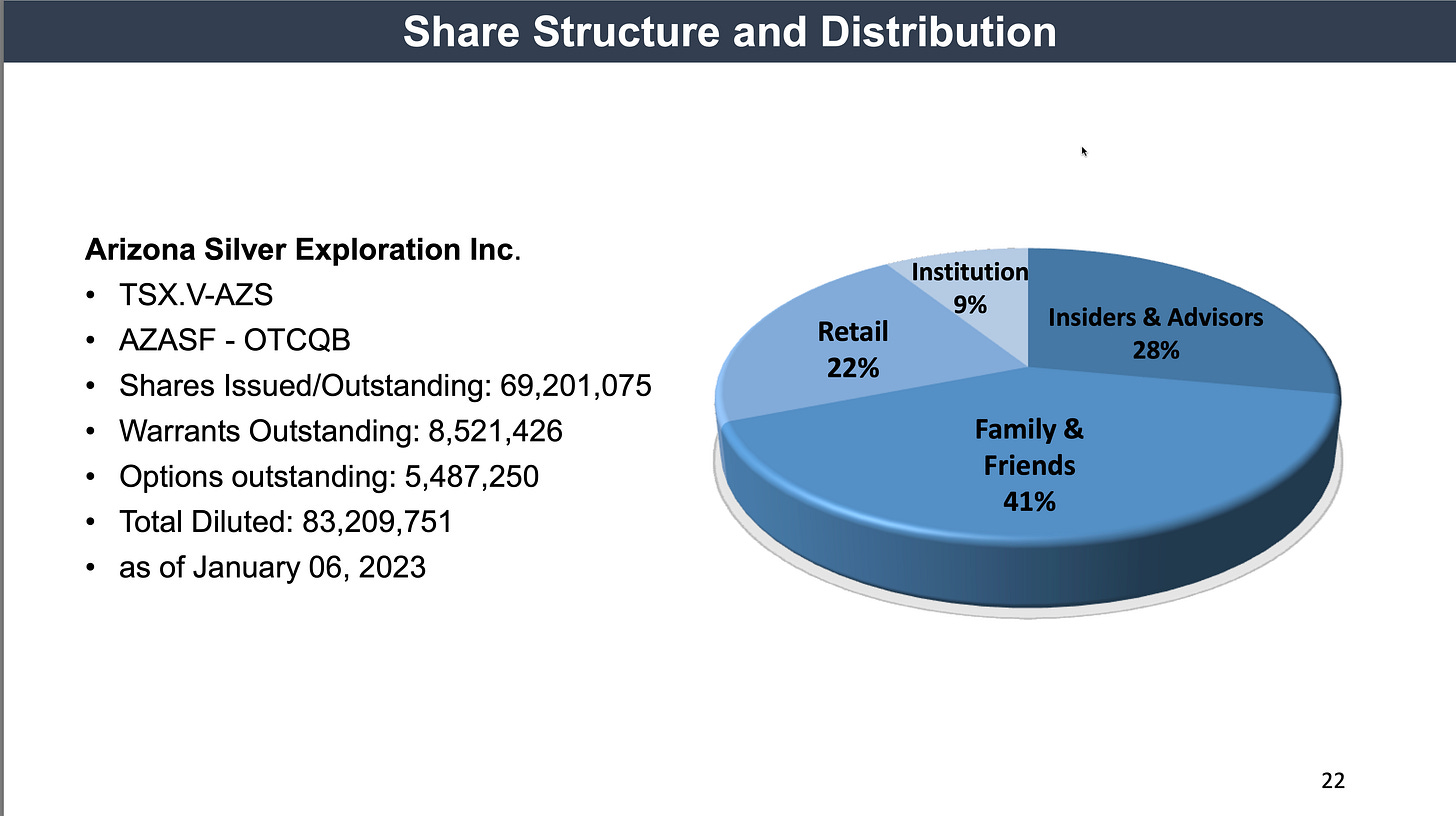

Arizona Silver currently has a market cap of $34 million Canadian, with one of the best share structures I have encountered in the junior mining space, which speaks volumes about what management has been doing. The company has 4 interesting projects in it’s portfolio, but is primarily focused on the Philadelphia Project in Arizona.

The Philadelphia Project is where I believe the big upside is going to come in 2023, the company has drilled a total of 110 holes on this property so far and has had some very impressive results to date. The strike length that has been drilled so far is 1.7 kilometres and there is still 1.5 kilometres that has been untested to the south and north.

The deposit is open at depth as the company has been drilling shallower holes thus far and getting alot of bang for their buck. The average thickness and grade of the holes drilled so far is 46 metres at .92 gpt Au, which I consider to be a very good result at a project like this one which will be easier to mine.

Okay so just based off these numbers above and by doing some rough math calculations I believe they likely already have over 1.5 million ounces of gold. So the company is already undervalued here, and has huge potential to expand what they already have here by drilling to the north and south and by drilling at depth. The company has only explored 40 acres of the 2400 acre land package they have.

Examples of some previous drill results below.

The company is going to be releasing lots of newsflow in 2023, and has many potential catalysts ahead to continue to push the share price higher. There is 12 holes that will be released any week now, and I believe they will be impressive based on recent news form the company. They have visibly mineralized intervals of 55-82 metres from the Rising Fawn Zone and 30-76 metres from the Perry Zone. Here is an image released by the company of the visible gold from one of the holes.

The company has just secured a core drill to test the Red Hill geophysical anomaly, they believe that this may be the feeder zone to the shallower mineralization they have been discovering. There will be 2 holes drilled totalling 700-750 metres. If they make a significant discovery here, this could change everything for the project and company.

I briefly mentioned the share structure earlier, Insiders and Family + Friends own almost 70% of all the shares, which means the stock is in very strong hands. The stock can be very volatile to the upside, and with so many catalysts ahead it could be a huge winner and has been performing very well recently.

Here is the weekly chart for the company, it’s been on quite a tear lately, it’s getting into an area here where it has no overhead resistance left. This is the kind of high potential junior mining stock I look to be involved with, as I really think the sky is the limit.

If you are interested in the story and want to know a bit more, check out this video where a director with a long history of success in the mining industry explains why he got involved with Arizona Silver and explains the potential catalysts ahead.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.