Mineros S.A - An under the radar gold producer

The stock has little hype behind it, it has a history of being a dividend paying machine and that is only going to get better going into a gold bull market.

Mineros has 2 gold projects in production right now, one is located in Colombia and other is Nicaragua. The company produces 250k ounces between the two last year. Each of these jurisdictions would be considered high risk, which I think explains some of the valuation here. The current market cap is $275 million Canadian, the company trades at a P/E ratio of 2.78 and trades at a massive discount to book value at 0.60, the balance sheet is in a very healthy position as well.

Mineros came onto my radar a few weeks ago, when the stock broke out on it’s bullish earnings report which coincided with the gold price breaking out. Here is the weekly chart below you can see the massive volume that has been pouring into the stock. It’s one of the most bullish charts I have come across recently.

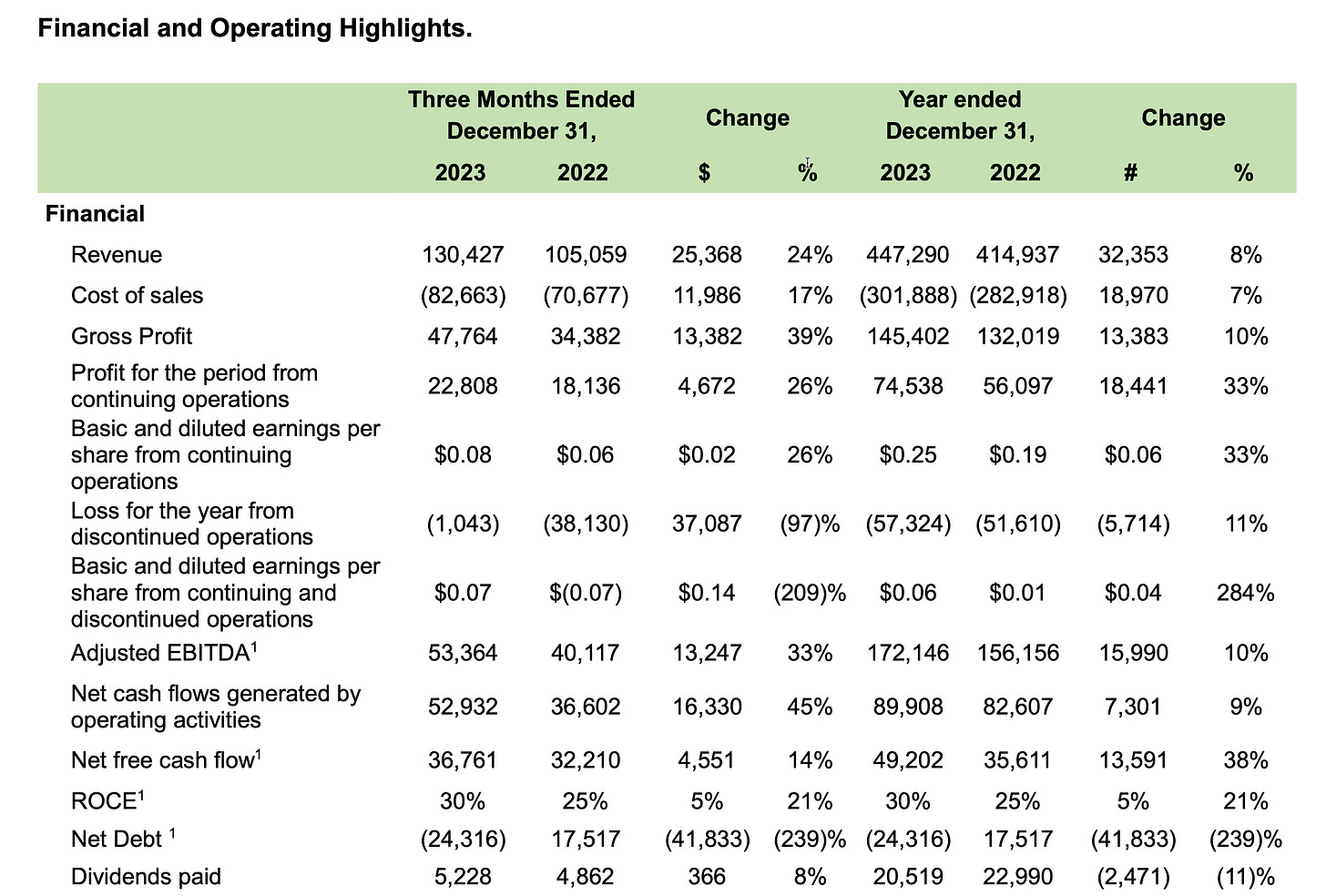

Here are some of the highlights from the Q4 Earnings report

-AISC is currently at $1300 between the two projects, which means the company is a cash making machine at the current gold price, which I expect can go much higher this year.

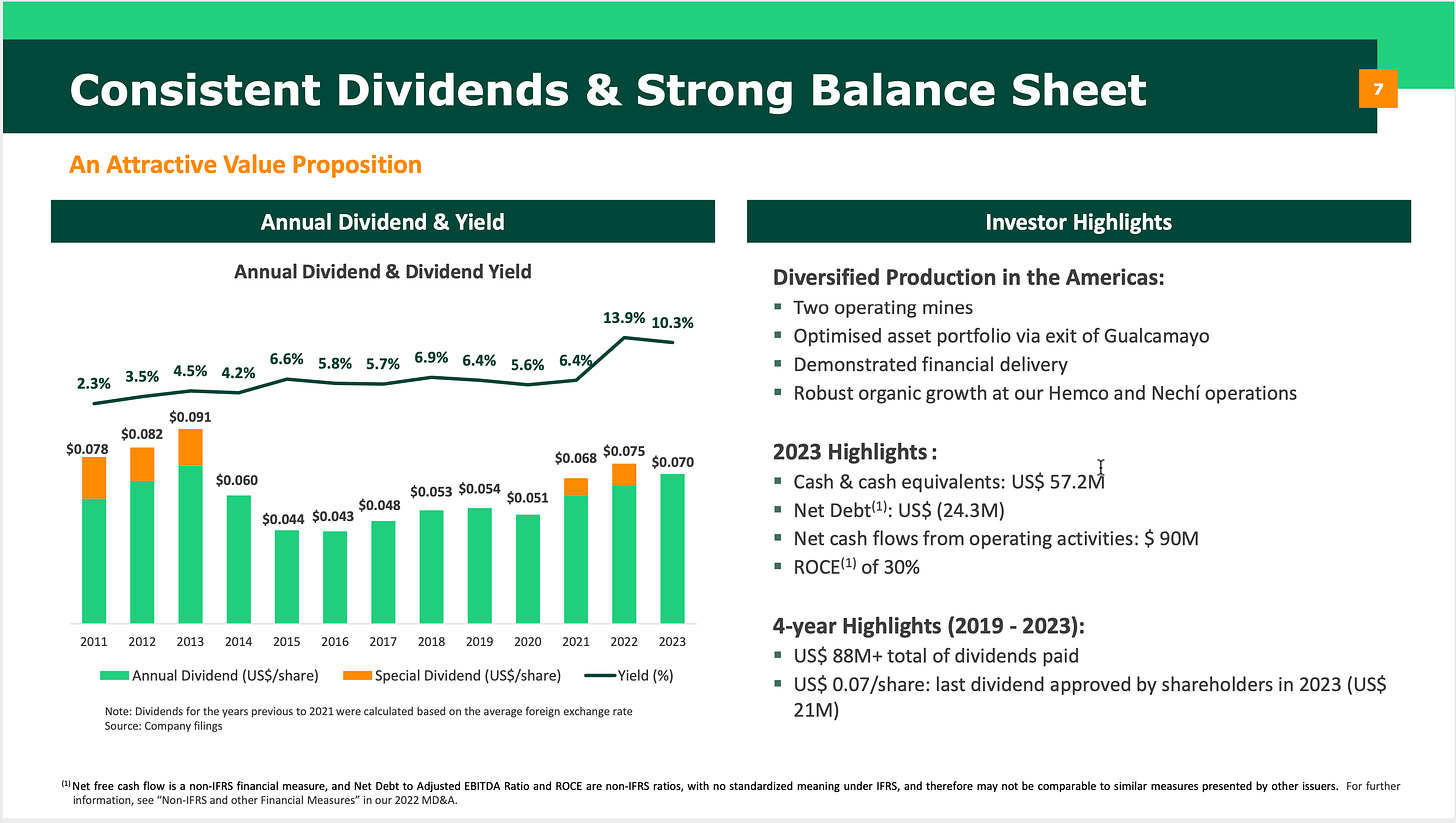

-The company was able to increase the dividend by 11% in 2023, the current annual dividend yield is still over 10%.

-There was large increases year over year across the board in many of the important financial metrics. This will continue to increase at current gold prices.

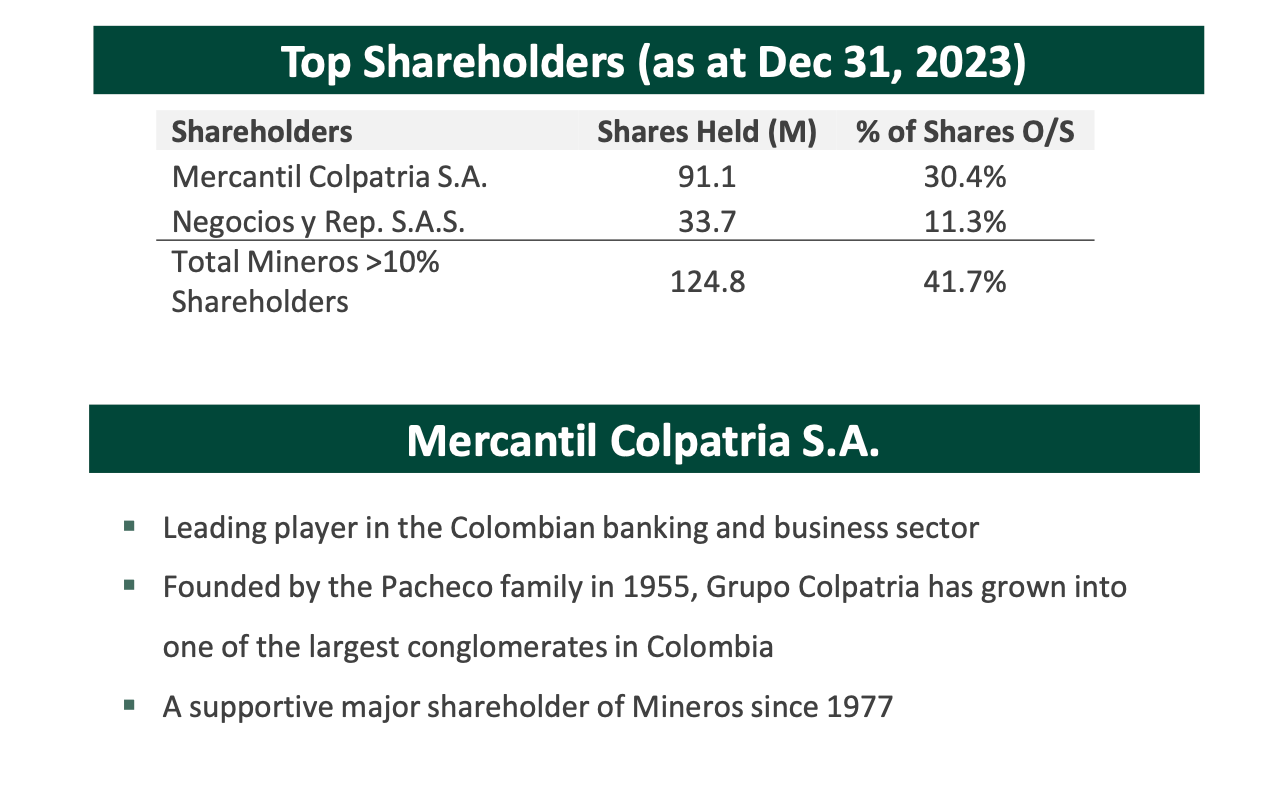

There is 2 large institutional shareholders that own over 40% of the company currently, one is a large player in Colombian banking/business sector and the other is an asset management company out of of Colombia. It’s always a positive to see shares in strong hands.

I really like the strong history of the dividends here and the balance sheet is very healthy compared to some of the other producers. The next quartely dividend is set to be paid out April 18, at .03 cents a share, with the ex-date being April.12.

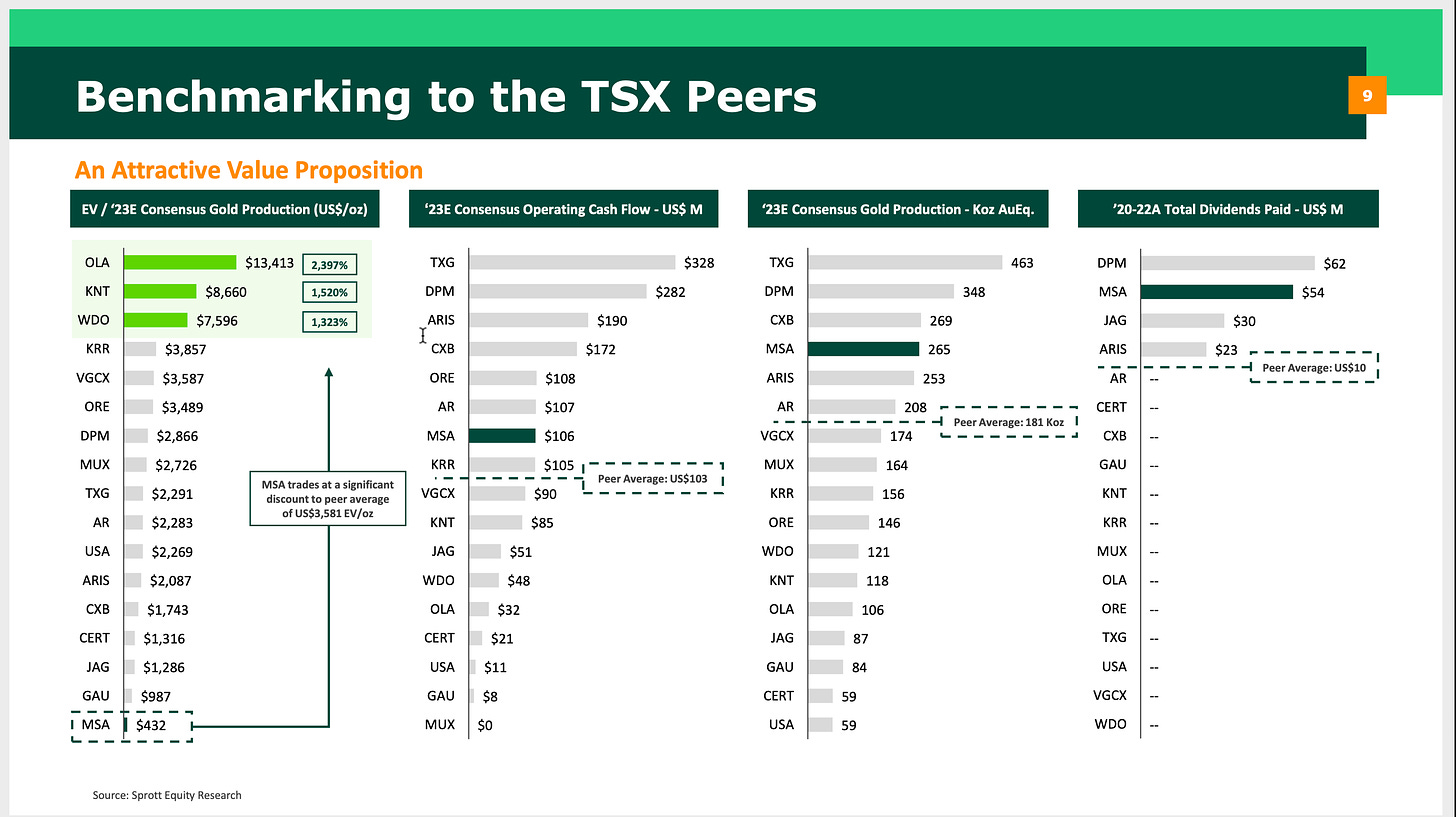

When compared to similar gold producers on the TSX, the company trades at a massive discount even with much better metrics than many of the other projects. Once again I believe the jurisdictions probably have lots to do with this.

It’s also important to mention the company still has over a decade of reserves at the Colombia asset and the company has been able to extend the life of the Nicaraguan asset into the 2030’s through effective drilling.

In summary the investment thesis is simple here, you have to believe the gold price stays at least relatively steady here with the possibility of much higher prices. Mineros is in a great fiscal position and is very extremely undervalued right now. The company has proven they can execute and margins will continue to increase at $2100 gold with the potential for the dividend to increase significantly. I believe this is a solid place to park some money for the next while.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.