Weekly Watchlist - Dec.23, 2023

I am still looking to add another position to the portfolio, here is 3 precious metal stocks I am watching closely this week as the sector slowly starts to turn upwards.

Firefox Gold - Market Cap $14 Million Canadian

Firefox Gold traded as high as .40 cents in 2021, it’s been showing signs of life lately, and this week really put it on my map. Breaking out of a base on above average volume. At a $14 million market cap, this is one of those stocks that can multiply quickly in a gold miner bull market.

The company has several exploration properties in Finland, the drill results from the Mustajarvi project are quite impressive including 16 metres @ 7.7 g/t Au and 13 metres @ 28 g/t Au. The company has been focused here recently.

Agnico Eagle just entered into an earn in agreement with Firefox on one of it’s other properties. Agnico now owns over 10% of the company, they have been heavily involved in Finland plays for awhile, the stock has had a nice bump up from the news. Crescat Capital also owns over 17% of the company.

Dolly Varden Silver - Market Cap $248 Million Canadian

Although the stock doesn't have the potential of Firefox, it is a safer silver developmental play. The stock got to over 1.20 earlier this year when it looked like silver was going to breakout. Trading has been fairly choppy lately, but if silver does breakout this will provide some nice leverage to the price.

Dolly Varden’s project is located at the southernmost tip of B.C’s golden triangle. The project already has a sizeable gold/silver resource with the potential to add more ounces through the exploration potential of the property.

Hecla Mining recently increased their stake in the company from 10% to 15%, the company is cashed up and shouldn’t have to raise money anytime soon as they look to continue drilling in 2024.

Vizla Silver - Market Cap $345 Million Canadian

Another large silver development stock that presents good leverage to the price of silver. Alot of these development stocks with large resources have been out of favour, but when silver rips they usually perform quite well. Vizsla has been in a tight base structure for over a year and there doesn’t look to be much downside here.

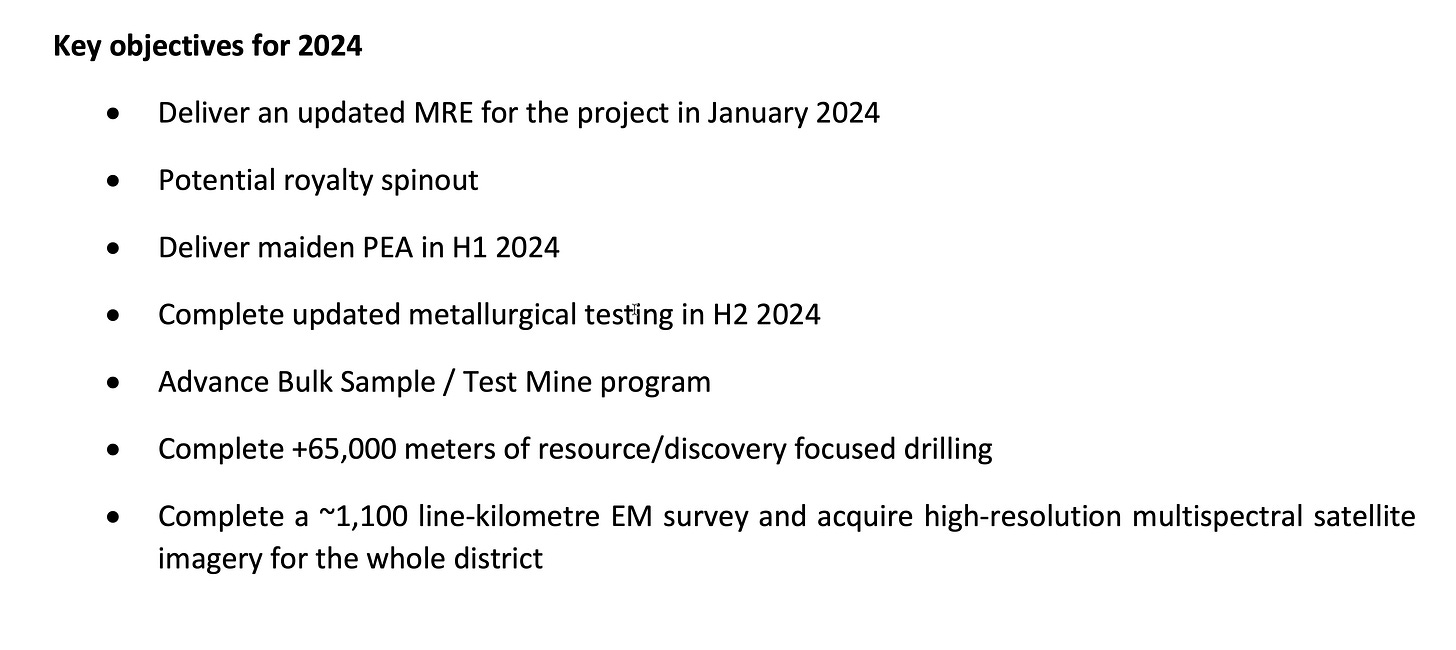

The company is focused on the Panuco project in Mexico , they came out with a mineral estimate in January which resulted in over 200 million ounces of AgEq. The company has been drilling aggressively throughout this year and an update to the resource is planned in early 2024.

The company is cashed up with $28 million dollars in the treasury and no debt. They believe there is still significant potential for resource expansion at the project moving forward. They continue to make new discoveries at the property.

There will be many catalysts in 2024 for the company to continue to deliver value for shareholders and with a potential silver bull market looming this could be a real winner.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.