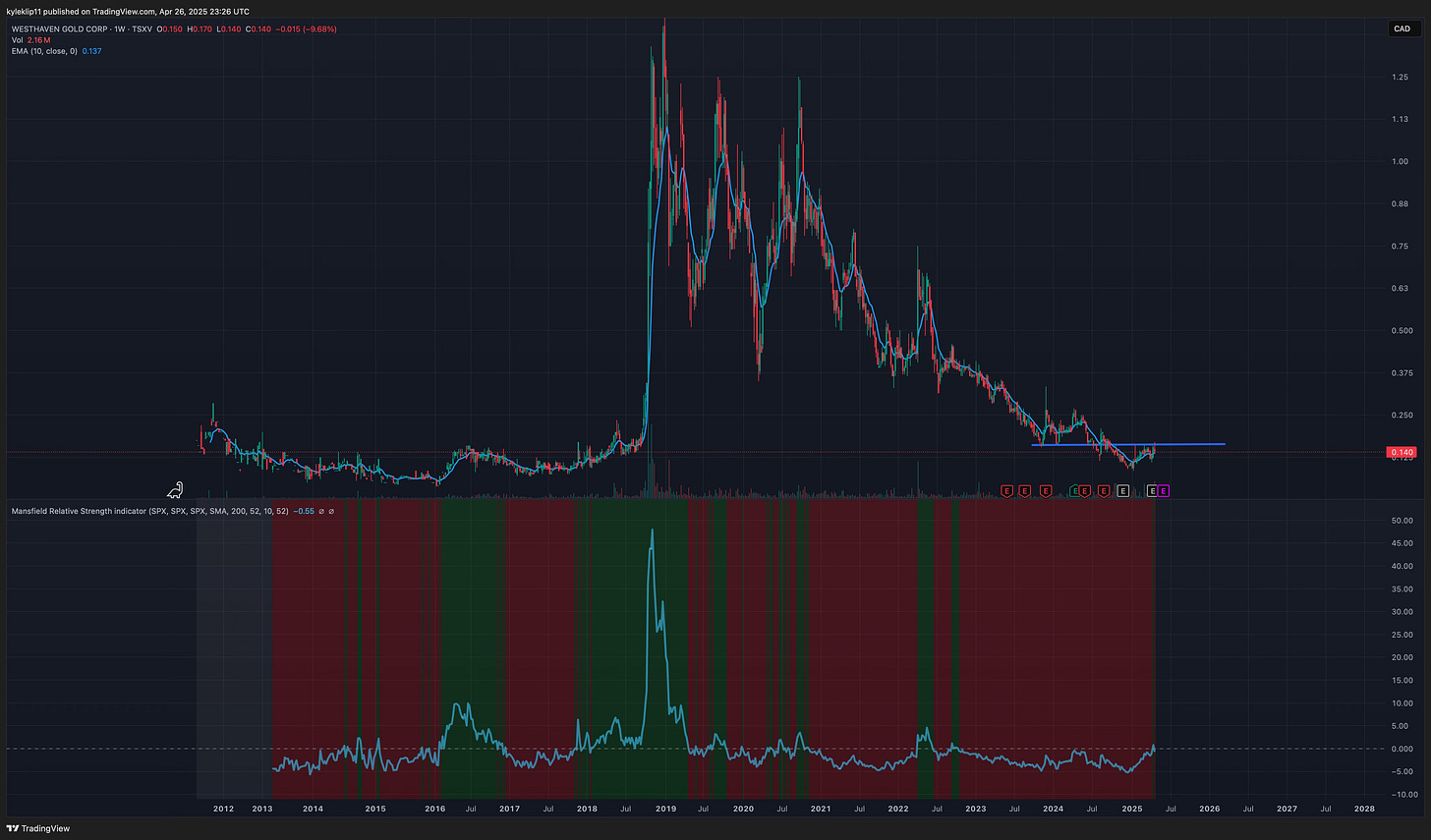

Westhaven Gold - Potential Bargain

I have been following this stock for awhile, it is one of the most beaten up gold stocks.

Westhaven is a company that has gone from a price of $1.44 in 2019 all the way down to .14 cents currently. It has been a complete round trip for the stock, and it’s not pretty. But I believe the current price presents a very interesting opportunity. Here is the weekly chart. We are back to levels not seen since they made there big discovery holes in 2018.

There has been alot of the work on the property since then, the company has done a more drilling with some exceptional holes and recently released an updated PEA. Below is an example of some of the drill holes.

SN18-14 (Oct 2018): • 17.77m @ 24.50 g/t gold, 107.92 g/t silver • Including 6.78m @ 50.76 g/t gold, 203.54 g/t silver • SN18-15: • 46.20m @ 8.95 g/t gold, 65.47 g/t silver • Including 5.00m @ 14.70 g/t gold, 215.00 g/t silver • SN18-12: • 1.65m @ 175.00 g/t gold, 249.00 g/t silver • Including 0.65m @ 285.00 g/t gold, 255.00 g/t silver • SN19-11: • 1.00m @ 557.00 g/t gold, 381.00 g/t silver • SN22-212 (Apr 2022): • 23.03m @ 37.24 g/t gold, 209.52 g/t silver (FMN Zone — highest grades to date) The companies project is at the shovelnose property, which is located only 30km from a main highway in a great jurisdiction in B.C. At a $2900 gold price, the After Tax NPV (at 6%) is $620 million USD. The company is currently trading at a $26 million dollar market cap in Canadian dollars. This is outrageous. This means that Westhaven is trading at 2.9% of its after-tax NPV. I don’t believe i have seen anything trade at this deep of a discount.

The company currently has $1 million in cash, so at some point in the near future they are likely going to have to raise some capital, although that may not be imminent. It may be one reason why investors have stayed away from the story.

The company recently changed leadership and Ken Armstrong is now the CEO, he has over 30 years of experience in the mining industry. It is part of the companies strategic plan to advance the project through the feasibility stage.

It’s hard to believe that many of these junior mining stocks haven’t really done anything even with the metal prices roaring higher, but here we are. I see it as an opportunity and something at this deep of discount has to revert to the mean in my opinion. I love deeply undervalued plays like this.

Another positive sign is that insiders have been adding alot of shares recently, this is always something I pay attention to.

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.

thanks for the excellent summary on this stock.